Investing in value stocks has long been a cornerstone of successful portfolios, and 5starsstocks.com value stocks are no exception. These stocks represent companies that are undervalued by the market but have strong fundamentals, making them attractive to investors seeking long-term growth. With a focus on identifying hidden gems, 5starsstocks.com provides insights and analysis to help you make informed decisions. Whether you're a seasoned investor or just starting, understanding the nuances of value investing can significantly enhance your financial strategy.

Value stocks are often overlooked in favor of high-growth companies, but they offer a unique opportunity for those willing to dig deeper. By focusing on intrinsic value rather than market hype, investors can uncover stocks with the potential for substantial returns. 5starsstocks.com value stocks are carefully curated to highlight companies with solid financial health, consistent earnings, and a competitive edge in their industries. This approach ensures that you are investing in businesses with a strong foundation and the ability to weather economic fluctuations.

As the investment landscape continues to evolve, staying informed about the latest trends and opportunities is crucial. The team at 5starsstocks.com is dedicated to providing up-to-date analysis and actionable insights to help you navigate the complexities of the stock market. By leveraging their expertise, you can build a portfolio that aligns with your financial goals and risk tolerance. In this article, we will explore the key aspects of value investing, delve into the specifics of 5starsstocks.com value stocks, and answer common questions to help you make smarter investment choices.

Read also:Dolly Parton Without Wig The Untold Story Behind The Iconic Look

Table of Contents

- What Are Value Stocks?

- Why Choose 5starsstocks.com Value Stocks?

- How to Identify Undervalued Stocks?

- Is Value Investing Right for You?

- Key Characteristics of Value Stocks

- What Makes 5starsstocks.com Unique?

- How to Build a Value Stock Portfolio?

- Can Value Stocks Outperform the Market?

- Common Mistakes to Avoid in Value Investing

- Final Thoughts on 5starsstocks.com Value Stocks

What Are Value Stocks?

Value stocks are shares of companies that are trading below their intrinsic value. This discrepancy often arises due to market inefficiencies or temporary setbacks that cause investors to undervalue the company. These stocks are typically characterized by low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, and high dividend yields. The underlying idea is that the market has underestimated the company's true worth, and over time, the stock price will rise to reflect its actual value.

Why Choose 5starsstocks.com Value Stocks?

5starsstocks.com value stocks are selected based on rigorous analysis and research. The platform focuses on identifying companies with strong fundamentals, such as consistent revenue growth, healthy balance sheets, and competitive advantages. By leveraging advanced algorithms and expert insights, 5starsstocks.com ensures that the stocks recommended are not only undervalued but also have the potential for significant upside. This makes it an ideal resource for investors looking to maximize their returns while minimizing risk.

How to Identify Undervalued Stocks?

Finding undervalued stocks requires a combination of quantitative and qualitative analysis. Start by examining financial metrics such as P/E ratio, P/B ratio, and debt-to-equity ratio. Additionally, consider the company's competitive position, industry trends, and management quality. 5starsstocks.com value stocks simplify this process by providing curated lists of stocks that meet these criteria, saving you time and effort in your research.

Is Value Investing Right for You?

Value investing is not a one-size-fits-all strategy. It requires patience, discipline, and a long-term perspective. If you're someone who prefers quick gains or is uncomfortable with market volatility, value investing may not be the best fit. However, if you're willing to hold onto your investments for an extended period and focus on fundamental analysis, value investing can be a rewarding approach. The key is to align your investment strategy with your financial goals and risk tolerance.

Key Characteristics of Value Stocks

Value stocks often share certain characteristics that make them appealing to investors. These include:

- Low P/E and P/B ratios compared to industry peers

- Strong dividend payouts

- Consistent earnings growth

- Healthy cash flow and balance sheets

- Competitive advantages in their respective industries

What Makes 5starsstocks.com Unique?

5starsstocks.com stands out in the crowded world of investment platforms by offering a combination of cutting-edge technology and expert analysis. The platform uses proprietary algorithms to screen thousands of stocks and identify those with the highest potential for value. Additionally, the team of analysts at 5starsstocks.com provides in-depth reports and insights to help investors make informed decisions. This blend of technology and expertise ensures that users have access to the best possible investment opportunities.

Read also:Unveiling The Life Of Rob Dyrdeks Wife A Deep Dive Into Their Beautiful Journey Together

How to Build a Value Stock Portfolio?

Building a value stock portfolio requires a strategic approach. Start by diversifying your investments across different sectors and industries to reduce risk. Next, focus on companies with strong fundamentals and a history of stable earnings. Regularly review your portfolio to ensure it aligns with your financial goals and make adjustments as needed. 5starsstocks.com value stocks can serve as a valuable resource in this process, providing curated lists of high-potential stocks to consider.

Can Value Stocks Outperform the Market?

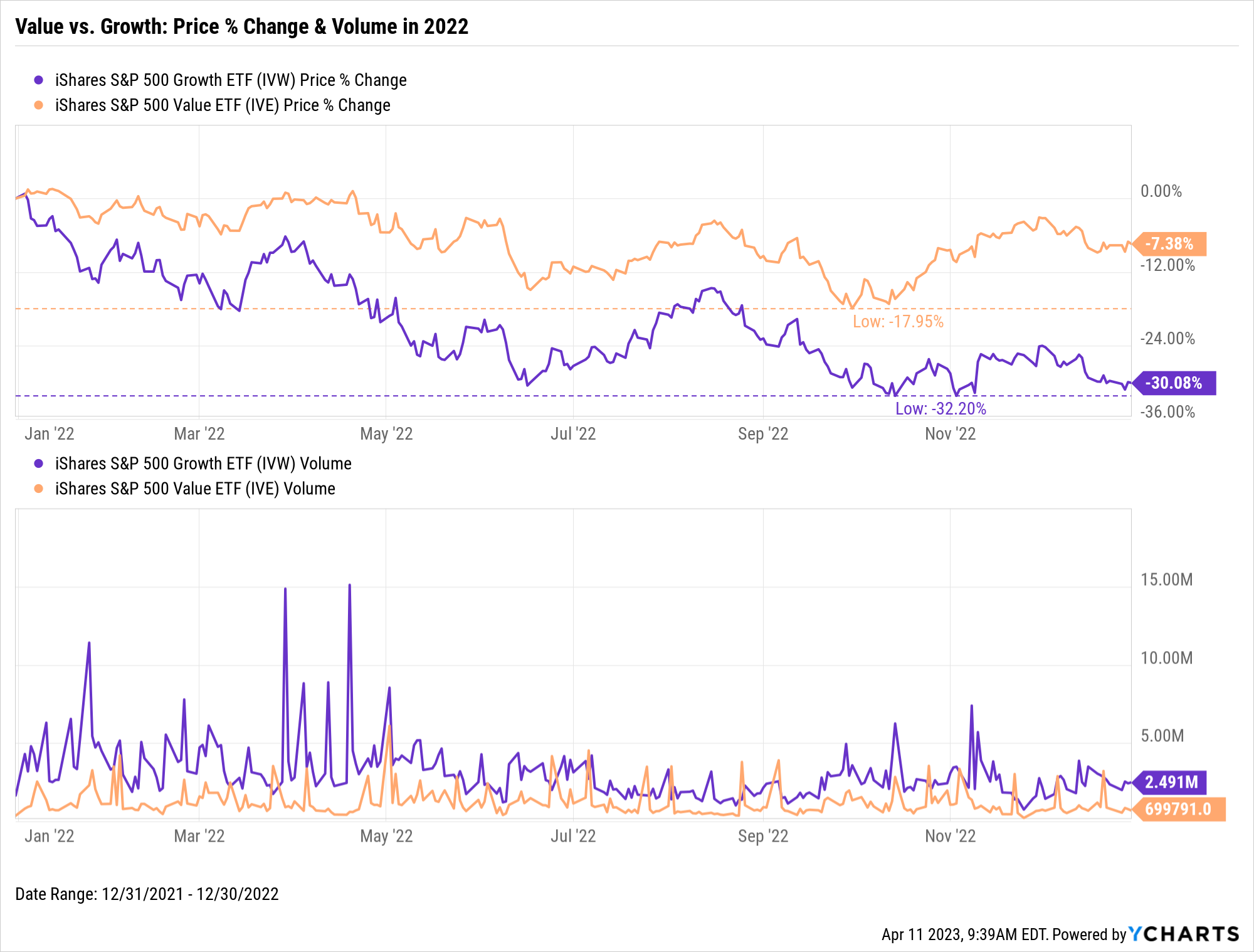

While there are no guarantees in the stock market, value stocks have historically outperformed growth stocks over the long term. This is because value stocks often have a margin of safety built into their prices, reducing the risk of significant losses. Additionally, as the market recognizes the true value of these companies, their stock prices tend to rise. By investing in 5starsstocks.com value stocks, you position yourself to capitalize on these opportunities and potentially achieve superior returns.

Common Mistakes to Avoid in Value Investing

Even experienced investors can fall into common traps when investing in value stocks. Some of these include:

- Overlooking qualitative factors such as management quality and competitive positioning

- Focusing solely on low P/E or P/B ratios without considering the company's overall health

- Ignoring macroeconomic trends that could impact the company's performance

- Failing to diversify your portfolio, leading to increased risk

Final Thoughts on 5starsstocks.com Value Stocks

In conclusion, 5starsstocks.com value stocks offer a unique opportunity for investors to tap into the potential of undervalued companies. By leveraging the platform's expertise and resources, you can build a portfolio that aligns with your financial goals and risk tolerance. Whether you're a seasoned investor or just starting, the principles of value investing can help you achieve long-term success. Remember to stay informed, remain patient, and focus on the fundamentals to unlock the full potential of 5starsstocks.com value stocks.

By following the insights and strategies outlined in this article, you can navigate the complexities of the stock market with confidence. The key is to stay disciplined, continuously educate yourself, and rely on credible sources like 5starsstocks.com to guide your investment decisions. With the right approach, value investing can be a powerful tool for building wealth and securing your financial future.